Every departure is special, each with its own financial plan and exclusive needs, but many of today’s retirement goals comprise achieving asset protection, growth opportunities, and a trustworthy income source. American Equity AssetShield Fixed Indexed Annuity are a long-term retirement relic that have facilitated many Americans preparation for income in retirement and stability their retirement assortment with payback like principal defense, tax-deferred growth and certain income that cannot be outlived.

What is a Fixed Index Annuity?

Fixed index annuities are one of the simply retirement vehicles specially designed to offer a prevailing combination of profit that protects principal, authorize for index-linked interest credit augment, provides tax-deferred growth and assurance profits over a selected period of time.

How do Fixed Index Annuities Work?

A fixed index annuity is a concurrence among you along with an insurance supplier, for example American Equity, which promises for main protection and a future profits source. The contract is buying using a lump sum or a series of payments, too recognized as premiums.

An annuity is buy from an insurance agent or financial expert who is licensed to sell annuities and can help you attain your long-term retirement goals.

The fixed American Equity AssetShield Fixed Indexed Annuity is painstaking an insurance product and is not frankly tied to or invested in the stock market or share possession. This function prevents the annuity contract from losing cash due to index volatility with the market going down and performing badly. The interest credited will by no means be less than zero.

What is a Lifetime Income profit Rider and How Does it effort?

The elective Lifetime Income Benefit Rider (LIBR) with a fixed index annuity from American Equity can help protected a guaranteed lifelong income basis. The income payments are drawn from an benefits account value (BAV) or income account value (IAV) which is credited over time using dissimilar crediting strategies depending on the annuity. The IAV or BAV is used to compute income or benefits payments, and is only obtainable through lifetime income or death profit payments. It is not accessible as a lump sum.

American Equity’s Fixed Index Annuities

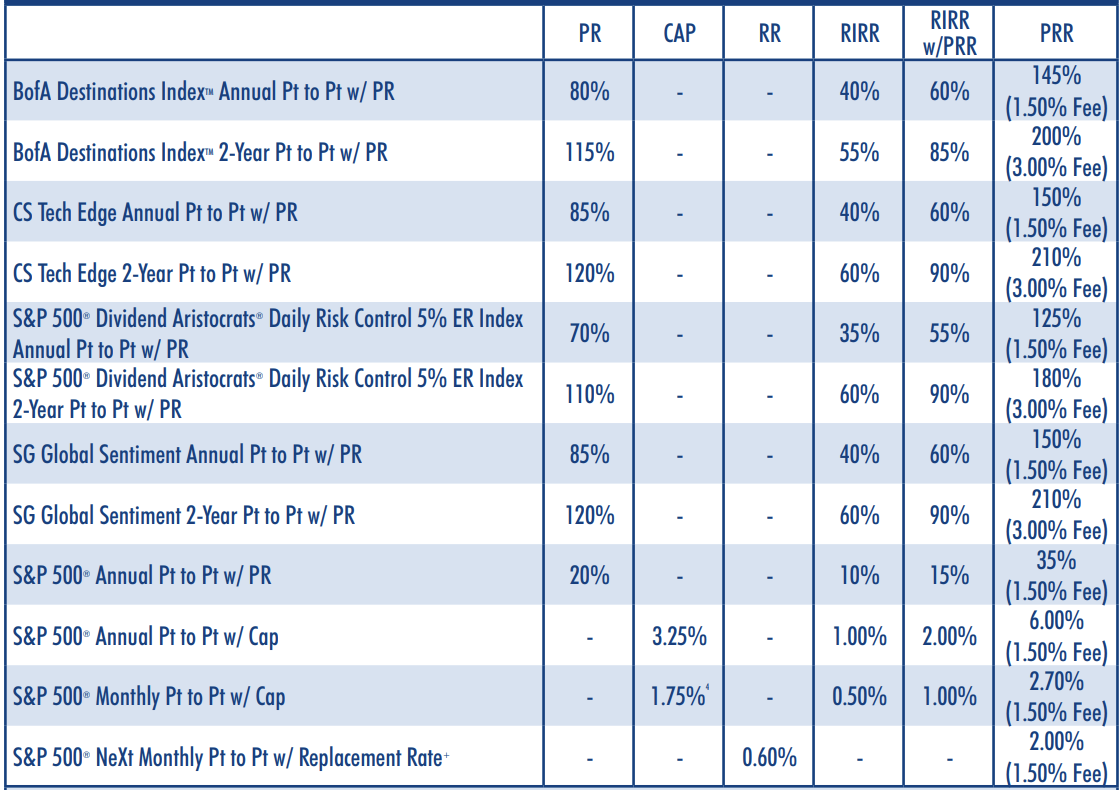

American Equity offers fixed index annuity products that offer different benefits and terms.

EstateShield

EstateShield 10 is a 10-year fixed catalog pension designed to assist adding up lifelong income with a certain income torrent that has the possible for annual increases, plus improved death benefits permitting beneficiaries to select how payments are received, leaving a legacy to loved ones.

AssetShield

The AssetShield 7 fixed index annuity is proposed to assist citizens reach their retirement purpose with chances for tax-deferred growth, benefit accretion and a seven-year surrender accuse agenda.

AssetShield

The AssetShield 10 fixed index annuity can assist with protection of hard-earned dollars though also allowing for growth and accretion. It comes with a 10-year surrender charge agenda.

IncomeShield

The IncomeShield 7 fixed index annuity with duration income benefit rider can proffer many benefits, as well as principal protection, tax-deferred growth and income that can’t be outlived. It comes with a seven-year give up charge schedule.

IncomeShield The IncomeShield 10 fixed index annuity with elective lifetime income advantage rider can help provide principal protection, tax-deferred growth and certain lifetime income. It comes with a 10-year surrender charge agenda.