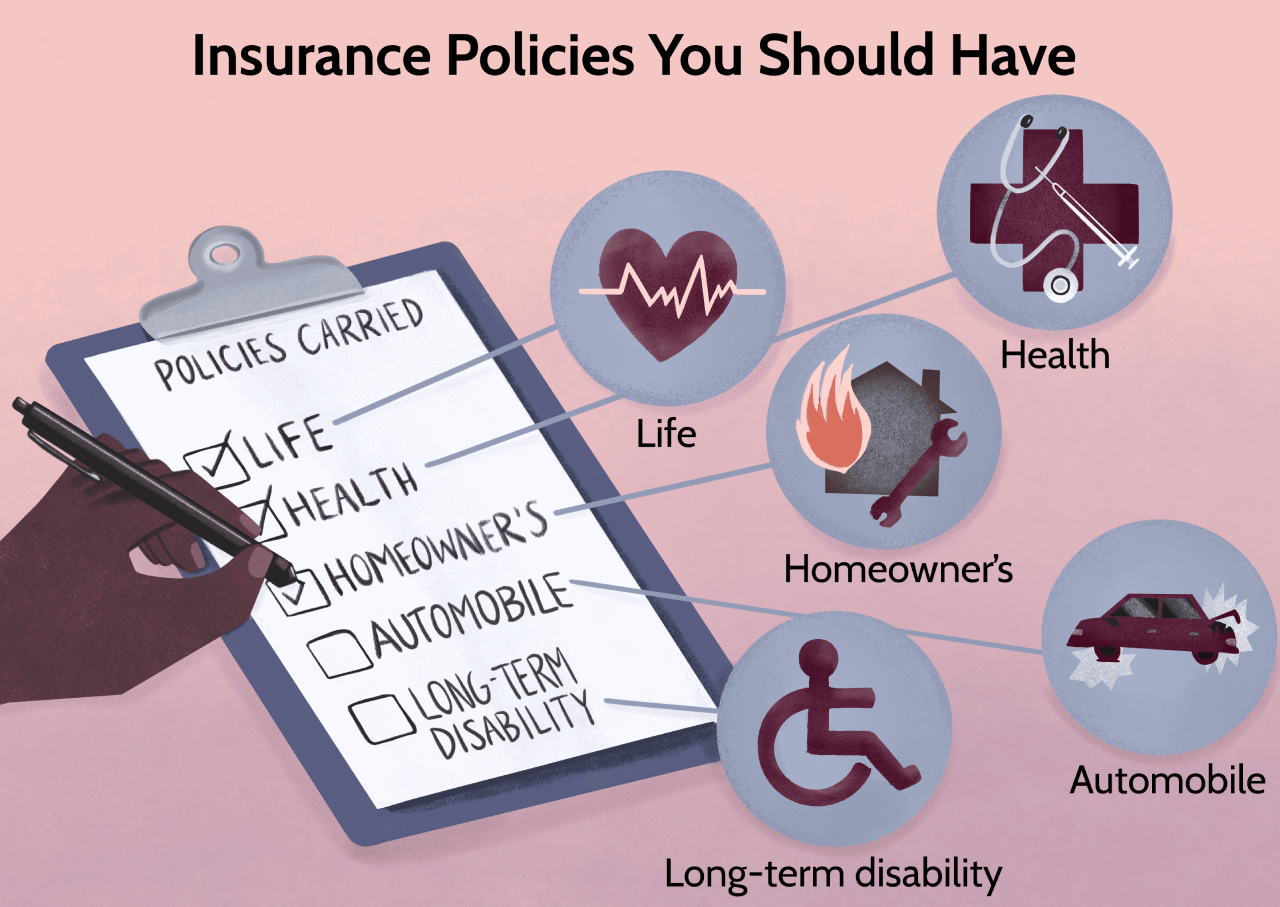

When it comes to insurance policies, it can be overwhelming to determine which ones are necessary and which ones you can do without. However, insurance is an essential aspect of financial planning and can protect you and your loved ones from unexpected events. In this article, we’ll explore the different types of insurance policies that are a must-have to ensure that you are adequately covered.

Introduction

Insurance is a means of protection from financial loss. The insurance industry provides policies that can protect you from unexpected events such as illness, accidents, natural disasters, and other unforeseen circumstances. It is crucial to understand the different types of insurance policies available to ensure that you and your loved ones are adequately covered.

Health Insurance

Health insurance is one of the most important types of insurance policies to have. It covers medical expenses, including doctor’s visits, hospitalization, and prescription drugs. Medical bills can add up quickly, and without insurance, you may be left with a hefty bill. Health insurance can also provide coverage for preventive care, such as regular check-ups, immunizations, and cancer screenings.

Auto Insurance

Auto insurance is required by law in most states and can protect you from financial loss in case of an accident. It provides coverage for damage to your car, as well as liability coverage for any injuries or damages caused to others in an accident. It can also cover theft and damage caused by natural disasters, such as hail or flooding.

Homeowner’s Insurance

Homeowner’s insurance is essential for anyone who owns a home. It provides coverage for damage to your home and belongings caused by natural disasters, theft, or vandalism. It can also cover liability for any injuries that occur on your property.

Life Insurance

Life insurance is not just for those who are older or in poor health. It can provide financial support for your loved ones in case of your unexpected death. It can cover funeral expenses, outstanding debts, and provide income replacement for your family.

Disability Insurance

Disability insurance can provide financial support if you become unable to work due to an illness or injury. It can cover a portion of your income, allowing you to focus on your recovery without worrying about financial instability.

Umbrella Insurance

Umbrella insurance provides additional liability coverage beyond what is provided by your other insurance policies. It can protect you from financial loss in case of a lawsuit or other unexpected events.

Travel Insurance

Travel insurance can provide coverage for unexpected events while traveling, such as trip cancellation, lost luggage, or medical emergencies. It can also cover emergency medical evacuation and repatriation.

Pet Insurance

Pet insurance can provide coverage for unexpected veterinary expenses, such as illness or injury. It can also cover routine care, such as vaccinations and check-ups.

Business Insurance

Business insurance is essential for any business owner. It can protect your business from financial loss in case of unexpected events such as lawsuits, natural disasters, or theft.

Flood Insurance

Flood insurance is essential for those who live in flood-prone areas. It can provide coverage for damage caused by flooding, which is not covered by homeowner’s insurance.

Identity Theft Insurance

Identity theft insurance can provide coverage for expenses incurred due to identity theft, such as legal fees and lost wages. It can also provide assistance with restoring your identity.

Long-Term Care Insurance

Long-term care insurance is essential for those who may need assistance with daily activities as they age or experience an illness or injury. It can cover the cost of in-home care, assisted living, or nursing home care, which can be very expensive without insurance coverage.

Conclusion

In conclusion, there are many types of insurance policies that are a must-have to ensure that you are adequately covered in case of unexpected events. Health insurance, auto insurance, homeowner’s insurance, life insurance, disability insurance, umbrella insurance, travel insurance, pet insurance, business insurance, flood insurance, identity theft insurance, and long-term care insurance are all essential policies that should be considered. It is crucial to review your insurance needs regularly to ensure that you are adequately covered.