Health insurance is not all homogeneous, but there are different types, depending on the coverage included and how to make it effective. Therefore, it is essential that, if you are going to take out medical insurance, you should first study its characteristics and opt for the one that best suits your specific needs.

Among the different types of health insurance, some of the most popular would be medical card insurance, with or without hospitalization, reimbursement insurance, and dental insurance. Each of these types has a different policy and covers different coverage.

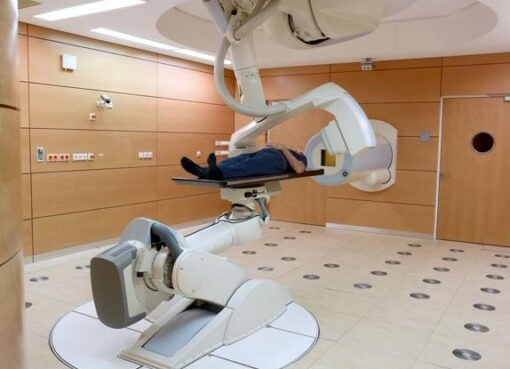

medical insurance

Within health insurance, the most demanded is the medical chart, also commonly called “health care insurance.” If you contract this kind of policy, you will receive the benefits of medical and health services that you need within a group of professionals and concerted centers of your insurance company. This type of insurance generally includes the expenses of medical consultations, clinical tests, diagnostic tests, emergency services, hospitalization, and others. One of the advantages of this insurance is that you can choose both the doctor and the hospital you want to go to, as long as it is within the list provided by the company.

This insurance can be, in turn, without copay or with a copay. If the insurance is without co-payment, you will be able to access, without any type of limit, all the health services included in your policy in exchange for the payment of a fee (normally monthly) without any other additional outlay. On the other hand, if you take out health insurance with a copay, you will have to assume part of the cost of the consultation, treatment, or test you receive. Obviously, insurance without copay is higher than that of another with a copay.

Medical insurance without hospitalization

Medical insurance without hospitalization would be a variety of health care insurance in which, as its name suggests, hospitalization coverage would not be included. Your premium is logically cheaper since the policy would not cover hospitalization or surgeries that require it.

reimbursement medical insurance

There is also the reimbursement of expenses within the different types of medical insurance. This modality does not give you access to any specific medical chart, but you will be the one who chooses the doctor and hospital center in each case, as well as the one who must pay the cost of the consultation so that later the insurer will reimburse you the amount agreed upon in the policy.

mixed insurance

The so-called “mixed insurance” would be a mixture of medical insurance and reimbursement insurance. In this modality, the insurer offers you insurance without copays with a certain medical chart, which you can go to if you wish; but, at the same time, it allows you to visit doctors and centers that are not part of the said medical list, in which case the company will reimburse you for the amount you had to pay, with the limits set out in the policy.

dental insurance

This type of insurance can be contracted individually or within a complete health policy. As a general rule, dental insurance is characterized by including some treatments in their entirety, such as tooth extractions or mouth cleanings. However, other treatments are only partially covered, so you will bear that part of them through a co-payment system.