New traders make many mistakes in their trading. It is necessary to recall certain trading tips through this non-exhaustive list.

Tips for new traders to perform best

Trading tip #1: Think in percentages

All new traders think about earned money. Since the number of their deposits is generally small, they use the leverage effect to magnify their gains (in the end it is their loss that is greater….). Winning €5 on trade is true that it’s not very selling. But on a €500 account, it represents 1%. It’s a great performance. So stop thinking about money. Have you ever seen a financial organization that does not speak to you in percentages? No, the only ones that do are the ads you find on binary options like earning €1500 in 2 hours.

Reasoning in money is only bad. To succeed in online trading Georgia, you have to be able to stop thinking about money. It avoids taking additional risks and it allows you to keep a cool head.

Trading Tip #2: Don’t Aim to Make Money

I know it may seem strange to say that since the majority of people come to the financial markets to earn money. This goal quickly becomes an obsession. Money is then your only guide and it leaves room for your emotions…. I’ll make it quick, you’ll end up razing your trading account. If you are new to trading and even if you are more experienced, the goal is not to make money but to last. Lasting allows you to progress, improve your trading and therefore ultimately make gains. If you are not interested in the financial markets and trading, then find another occupation. In trading, there must be a notion of pleasure, a desire to learn, to work on yourself…

Trading Tip #3: Always Set a Stop Loss

It’s a classic but it never hurts to repeat it. When we look at the statistics of brokers, we see that a large majority of new traders do not put a stop loss. In some cases, they end up cutting their position manually, disgusted by the trading, but it’s already too late. As a result, their average gains are lower than their average loss across all of their trades. Difficult to win in these conditions. I invite you to consult the sheet on Let your gains run and take your losses.

A stop loss is mandatory in all of your positions. So stop playing smart and thinking you’re stronger than everyone else, accept your loss! You can’t win in trading if you can’t lose.

Trading Tip #4: Take the Time to Train Yourself Properly

Train well, it implies going through the demo account box!! And when I say demo account, it’s not just to test the platform by placing a few trades… The demo account is where you should build the foundations of your trading strategy and learn how to manage your risk. A demo account actually teaches you discipline and rigor which are two essential elements if you do not want to raze your trading account. So yes, it’s sometimes boring to be on a demo account, but remember trading tip #2….

Becoming a trader takes time, work, and a lot of patience! If you are in a hurry in life, move on, trading is not for you! Trading is a bit like golf, you think you have it all figured out one day and in fact, you don’t.

Trading tip #5: Don’t anticipate moves

It is a great classic for beginner traders. It detects a buy or sell signal but does not wait for it to be validated to take a position. For example, it will enter long before the breakout of the neckline of a double/triple bottom. For him this figure is bullish, so why wait… Two reasons:

– As long as the buy/sell signal is not given, the uncertainty on the future evolution of the price is stronger. Technical analysis is based on probabilities. If you do not wait for the confirmation of the signal, you greatly reduce the probability of success of your trade.

– It creates regret. You tell yourself afterward that you should never have taken this trade since the signal was not given. And regrets lead to lots of bad things in trading, it’s an open door to emotions (enemy of the trader, see psychology and trading …). If you waited for the buy/sell signal to take a position, you have nothing to regret. It’s quite simple that the market didn’t agree with you, but that doesn’t mean that you were wrong to take the signal…. Being wrong and the market giving you wrong are two totally different things!

Trading Tip #6: Stay Focused on Technical Analysis

If you do technical analysis, don’t pollute your mind with fundamental analysis. To master fundamental analysis, you need knowledge that beginners generally do not have. In addition, the fundamentals sometimes send signals contrary to the technical analysis and suddenly, you feel lost, you do not know what to do. In the long term, fundamental analysis is always right, but if you seek to use it in the short/medium term, the effects are disastrous. If you want to have a broad view of the courses, look at the daily or weekly charts.

Nor should you pollute your mind with the various news that is published throughout the day. It just confuses you, you look for logical reasoning for the market reaction, and often there is none. It is simply the machines with high-frequency trading having fun… If the movement after the news is clear, technical analysis will allow you to capture it. No need to look at the published figure. You can do it, but after the fact, with your head rested, not in the heat of the moment.

By dint of hearing things everywhere, they end up influencing us in our trading, by giving us a meaning to trade. We have somehow already made our choice in our head and we are limited to seeing only that. This type of behavior leads to errors, to misinterpretation of signals sent by technical analysis.

Attention, I am not saying that one should not look at the international economic calendar of the day to see the various publications. Being aware that news is going to be published is good (it allows you not to be surprised by the volatility), but trying to analyze it is, in my opinion, to be avoided.

publications. Being aware that news is going to be published is good (it allows you not to be surprised by the volatility), but trying to analyze it is, in my opinion, to be avoided.

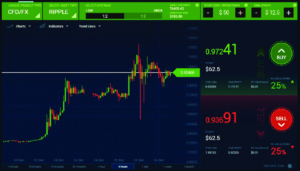

Trading Tip #7: Don’t Use Leverage

Leverage is poison. For individuals, it should be prohibited or strongly limited in each position. Use a little leverage on all of these positions, why not in moderation, but using leverage on a single position will inevitably lead to the loss of your capital.

I tear my hair out when I see some newbie traders looking for brokers with the most leverage. Leverage is your enemy. If you think to leverage, you think money, and if you think money, your emotions will dictate your trading and you will lose all your capital. If almost all retail traders are losers in the financial markets, it is because of this. Stop thinking you are superior, you are like everyone else, run away from the lever and try to last instead.

If you trade CFDs, never use leverage! If you trade on Forex, always choose a broker with micro lots (0.01 or 1000 units). If you have a small trading account, you will be forced to use leverage despite yourself (if you deposit less than €1000), so limit your number of simultaneous positions (2 or 3, never more).

Trading Tip #8: Build Confidence

New traders always tend to want to copy everything mindlessly. You don’t copy a trade just because the trader is supposedly good, you only copy it if you fully agree with what he says, if it’s in line with your trading strategy. You will not earn money by copying a trader for the simple and good reason that you do not know how he manages his risk, when he cuts his position exactly if an element has made him change his mind… Copy it doesn’t teach you how to trade, it just makes you dependent. Get inspired yes, copy no!

Your best advisor is yourself. To gain self-confidence, the demo account is for that. It will also allow you to gain confidence in your trading strategy and to be able not to question it at the slightest loss phase. It’s essential.

To have self-confidence is to dare to take a position when your trading strategy gives you a buy/sell signal, dare to go to the end of your trade (do not cut your position too early in gain), and know how to take your loss when necessary while knowing that we will be able to make up for it later…